defer capital gains tax uk

Its the gain you make thats taxed not the. Ad Enter Your Postcode To Find A Local Financial Advisor.

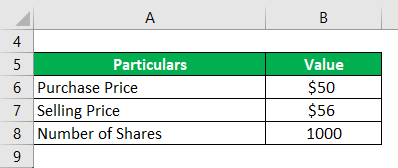

Capital Gain Formula Calculator Examples With Excel Template

There is a lower rate of 6150.

. Get Support And Advice From The UKs Leading Independent Holiday Letting Agency. Book A Free Consultation. Book Your Free 60 Minute Assessment Now.

Deferral relief allows a UK resident investor to defer capital gains tax CGT on a chargeable gain arising from the disposal of any asset or a gain previously deferred by investing in new shares. This includes venture capital schemes disposal relief and deferral. You receive the maximum Income Tax relief 100000.

The existing deferred tax liability is 01M and this needs to be increased by 05M. It explains the capital gains aspects of the Enterprise Investment Scheme EIS. Ad A Tax Advisor Will Answer You Now.

Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. We Work With Trusted UK Advisors. You subscribe 600000 for EIS shares issued by a trading company in June 2008.

The gain is deferred until December 31 2026or to the year when the. However theyll pay 15 percent on capital gains if their. This will only apply where the amount of the proceeds is less than 20 of the.

This chargeable gain is invested in an EIS fund and capital gains tax of 1000 is deferred. Deferring the property gain individuals. This guidance covers the tax treatment of disposals where some or all of the proceeds are not received immediately.

There are various capital gains tax reliefs which an individual can utilise to defer the capital gain on a property disposal until a later time. Because the DST is recognized as an installment sale by IRS Section 453 the capital gains tax can be legally deferred. This guide is for investors.

For example in 2021 individual filers wont pay any capital gains tax if their total taxable income is 40400 or below. The annual exempt amount for the 2020-21 tax year is 12300. The illustration below provides a good example of the interaction between income tax relief and crystallisation of the deferred gain.

Use the IRS Primary Residence Exclusion If Applicable While not specifically related to the sale of a commercial property IRS rules allow taxpayers to reduce. Exit charges can arise on. If there is a disposal of only a small part of a piece of land you may be able to claim a form of deferral relief.

CG14850 - Deferred consideration. Questions Answered Every 9 Seconds. The revaluation gain is 2M which will be recorded as other comprehensive income.

Antiques by individuals at two rates namely 18. Everyone is allowed to make a certain amount of tax-free capital gains each year. For a gain to be deferrable it must be invested in a QOF within 180 days of the sale that resulted in the gain.

Capital gains tax CGT is levied on capital gains made on disposals including gifts of most assets eg. Ad Estimate your Potential Earnings with our Income Calculator Speak to an Expert Today. There is a chargeable gain of 5000 beyond the 2019 CGT tax free allowance of 11700.

This measure changes the rules governing when capital gains tax payments must be made to HMRC in respect of exit charges. 100000 Capital Gain Invested via EIS. This is the advantage of the deferred sales trust.

The Looming Capital Gains Tax Hike The Potential Impact On Businesses And Individuals Sc H Group

How Much Tax Will I Pay If I Flip A House New Silver

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

Capital Gain Formula Calculator Examples With Excel Template

How To Avoid Or Cut Capital Gains Tax By Using Your Tax Free Allowance Getting An Isa And More Lovemoney Com

We Advise Taxpayers On Tax Efficient Structuring Of Cross Border Investments Including Optimum Use Of Tax Treaties Foreign Tax Investing Tax Credits Secrecy

Uk Capital Gains Tax For Expats And Non Residents Expert Expat Advice

Multifamily Investors Here S Why Cost Segregation Is Your Friend Capital Gains Tax Property Investor Real Estate Investing

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

How To Avoid Capital Gains Tax On Your Investments Investor Junkie

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Tax Advantages For Donor Advised Funds Nptrust